...

The College Official Occasion Expense Forms (OOEF) policy pertains to all entertainment expenditures.

...

Entertainment expenditures include food and beverages, facility rentals, flowers, invitations, and other similar expenses and must serve a business purpose.

Best Practices

- All entertainment payments require an approved Official Occasion Expense Form.

- The University is exempt from the mixed beverage tax and state sales tax.

- Preapproval is required for purchases made using the procard. Please include "preapproval" in the OOEF document ID field.

- Receipts and invoices must be attached unless the OOEF is for preapproval. For preapproved events, receipts and invoices must be uploaded to the OOEF once received.

- If the Dean hosts an event, special processing is required. Please contact the Dean's Office.

- When possible, a house account (direct bill/ invoice for payment) should be used for vendors.

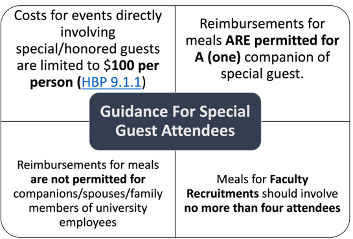

- Reimbursements for employee companion meals are not permitted unless the donor/distinguished guest has a companion in attendance.

- Tips should not exceed 20% of the subtotal (excluding taxes, and fees).

- See the OOEF policy for guidelines regarding per person limits for your different event types.

- The OOEF should reflect a business reason and benefit to the university. Please see Frequently Asked Questions for examples.

- All vendors for a single event should be included on one OOEF, include explanation in the notes section.

- If the number of guests listed on the receipt differs from the amount listed on the OOEF, please include a note to explain.

- Sales tax is reimbursable for dine in meals only.

- If a bartender is involved, a Purchase Order must be issued before the event, which includes the following statement "Bartender must have a TABC license". (*Note: if the vendor is requiring a signature/agree to terms and conditions for the event, a full contract is needed instead of a Purchase Order)

Frequently Asked Questions

The college has compiled a list of the most often asked questions in an effort to provide further guidance for OOEF creators and reviewers.

Contact

GEB-business@austin.utexas.edu

For CBS Clients, please contact your group.

External Resources

Handbook of Business Procedures 9.1.1

Types of OOEFs|Food & Miscellaneous |Alcohol | Taxes | Delivery & Fees | Attendees

_________________________________________________________________________________________________________________________

Types of OOEFs

Pre-Approval:

Events that exceed an estimated budget of $1,000 or events that will serve alcohol during a breakfast or lunch meeting require a final approved OOEF prior to the event date. You will need to submit an itemized budget using the budgeting spreadsheet link here. Please submit as soon as possible to ensure the OOEF is final approved prior to the event date. The average turnaround time once the OOEF is at the Dean’s Office for review is 5-7 business days.

Post Event:

Events that have an estimated budget that is less than $1,000 can have OOEFs submitted after the date of the event. These OOEFs should have stamped itemized receipt(s) and invoice(s) included as attachments. Please note the system allows for a maximum of 5 attachments per OOEF, so some items may need to be combined before being uploaded. It is generally best practice to submit an OOEF prior to the event or meeting; however, circumstances may not allow for that, in which case please be sure to follow the guidance above.

Multiple OOEFs:

There are some situations where more than one OOEF may be required due to the nature of the meeting or event. If your event spans multiple days, the cost of the event differs by more than 10%, or the intended audience changes throughout the day, multiple OOEFs would be required. The examples listed below are not meant to be an exhaustive list, but the most common reasons.

Blanket:

If you answer ‘yes’ to all these questions, you are eligible to submit a blanket OOEF for your entire event. When submitting blanket OOEFs, an estimated budget for the event is required. You can find the budgeting spreadsheet here.

- Is the event part of a recurring series over a period of time such as a semester or fiscal year?

- Is the title and purpose of the event the same for each occurrence?

- Is the “host” and core audience/group for the events the same for each occurrence?

Useful Resources:

_________________________________________________________________________________________________________________________

Food & Miscellaneous

Includes food, non-alcoholic beverages, flowers, greeting cards, and miscellaneous supplies (such as pens, sticky notes, paper clips, tissue, hand sanitizer, etc.) for the event. Please use the “Delivery/Fees” field for other types of costs such as linens, A/V rentals, or facility rental fees.

_________________________________________________________________________________________________________________________

Alcohol

Alcohol will only be reimbursed up to 50% of the food and drink subtotal before tax, tip, & fees. Per UT policy, alcohol costs more than 50% of the food and drink subtotal before taxes, fees, and tips, will not be paid using UT funds.

Example: If food = $50.00, alcohol cannot exceed $49.99; Subtotal would be $99.99 and alcohol percentage would be 49.99%.

Useful Resources:

List of Pre-Approved Venues On-Campus to Serve Alcohol

Alcohol Exception Request Form

Handbook of Business Procedures: Alcohol (9.1.1.F and 9.1.1.H)

_________________________________________________________________________________________________________________________

Taxes

Provide vendors with tax exemption certificate below to exempt your purchases from sales tax. Sales tax can be reimbursed for an employee who paid for a business meal that was eaten at the restaurant with personal funds.Otherwise, sales tax is not reimbursable.

Useful Resources:

Handbook of Business Procedures: State Sales Tax and Mixed Beverage Sales Tax (9.1.1.M.1.f)

_________________________________________________________________________________________________________________________

Delivery & Fees

Includes delivery fees, rental fees, AV fees, and any other fees that do not fit in the “Food & Misc.” section. Service fees can also be included in this section, as long as tip is not included within the service fee charged by the vendor. If you have questions about whether this is applicable, please reach out to the vendor to gather clarification.

_________________________________________________________________________________________________________________________

Attendees

Please be as accurate as possible when describing who will be attending an event, as this will influence the guidelines around the event. See below for more details regarding the restrictions for each group type.

Student Attendees

UT Employee Attendees

Donors, Speakers, Special/Honored Guests/Companions, and Recruitment Attendees

Questions?

If you have questions regarding any information listed above, please contact la-finance@austin.utexas.edu.

...